Table of Contents

- New Tax Brackets 2025 by IRS - Markets Today US

- Breaking Down The 2025 US Tax Brackets | Taxgoddess.com

- Trump’s tax cuts could expire after 2025. Here’s how top-ranked ...

- Tax Brackets for 2025 vs. 2025: How Much Will They Change?

- Tax Brackets for 2025 - The Living Planner

- 2025 Income Tax Brackets and How They Can Affect Small Businesses ...

- Infographic: 2025 Tax brackets are out | Yield PRO

- Planning for Taxes 2025: Inflation Edition | White Sand Wealth

- Here are the new income tax brackets for 2025 - Bronx Place News

- 2025 tax brackets: What you need to know for next year's tax season ...

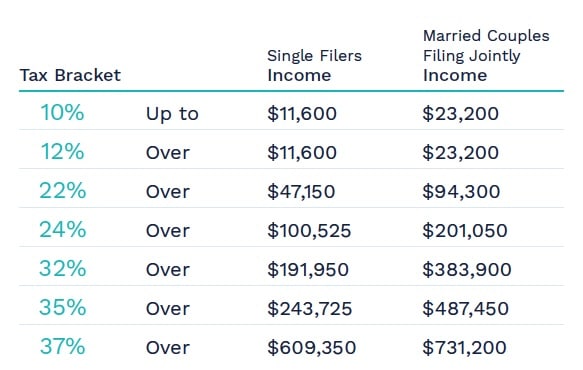

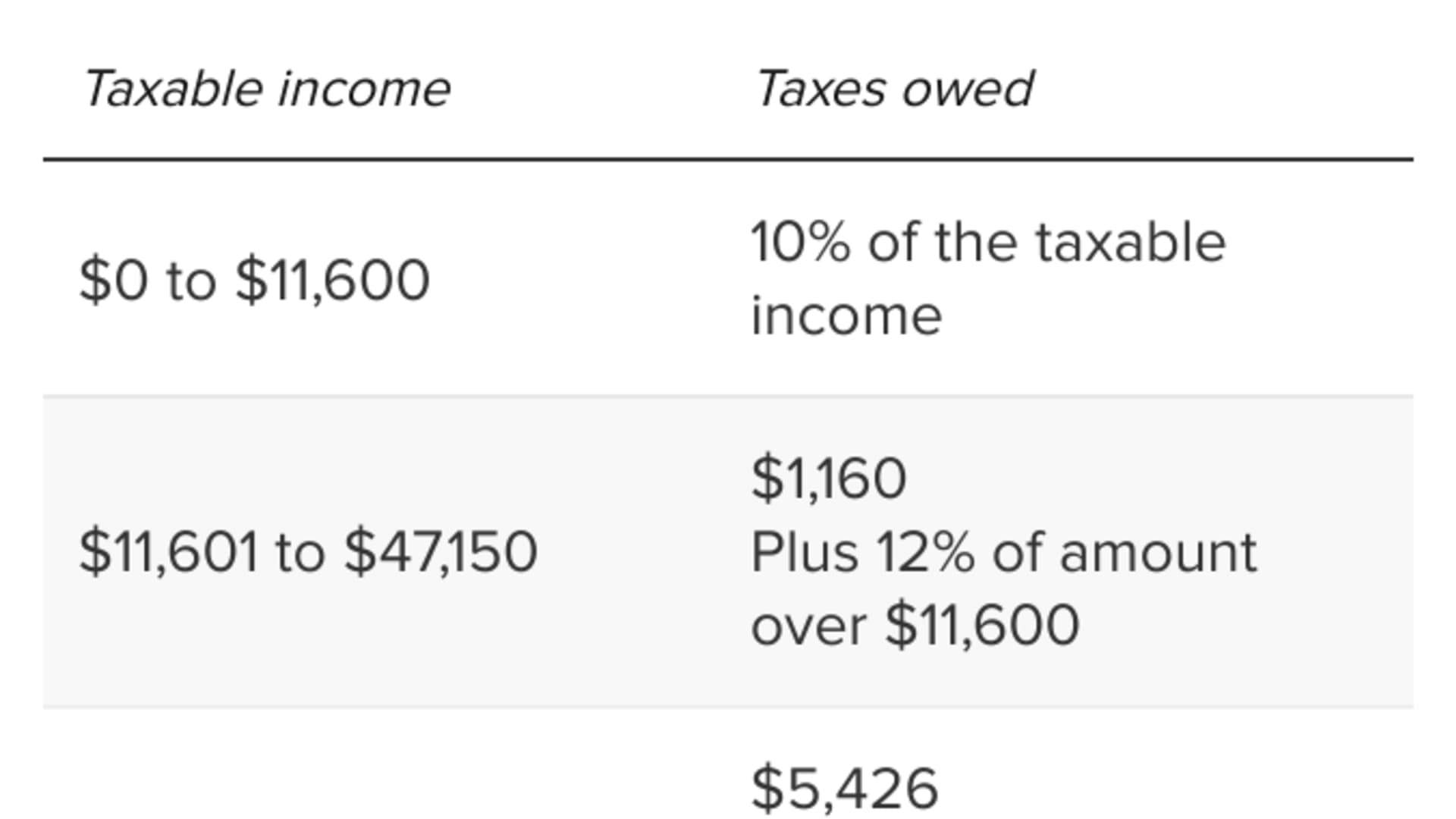

Tax Brackets and Rates

Standard Deductions

Retirement Contribution Limits

The IRS has also adjusted the contribution limits for retirement accounts, such as 401(k) and IRA plans. For tax year 2025, the contribution limits are: $22,500 for 401(k) and other employer-sponsored retirement plans $6,500 for IRA plans These increased contribution limits will allow taxpayers to save more for retirement, potentially reducing their taxable income and lowering their tax liability. The IRS tax inflation adjustments for tax year 2025 will have a significant impact on various tax provisions, including tax brackets, standard deductions, and retirement contribution limits. Taxpayers should be aware of these changes and how they may affect their tax situation. By understanding these adjustments, taxpayers can better plan their tax strategy and potentially reduce their tax liability. It is essential to consult with a tax professional to ensure compliance with the new tax laws and regulations.For more information on the IRS tax inflation adjustments for tax year 2025, visit the IRS website. Stay informed and up-to-date on the latest tax news and developments to ensure you are taking advantage of all the tax savings opportunities available to you.